Lessons to Help Cannabis Growers Make Money

Cannabis cultivators bet on each crop’s success and on getting paid on time for their harvest.

As this quote implies, cannabis farmers take the most risk. No logical argument against this statement exists. They bet on each crop, and they often are the last to be paid. There is a certain intelligentsia emerging in cannabis which seems to dismiss farmers as the invisible component of what they fashion as the cannabis business. You will hear statements like “it is just farming,” or, “it is all about brands,” or the dismissive, “Starbucks doesn’t grow their own coffee.” This is the environment in which farmers live.

When looking at the current revenue-linked arrangements from farm to bowl, it is apparent that the cannabis supply chain breaks down without a stable and prospering grower community. When the dispensary doesn’t pay the wholesaler, the wholesaler doesn’t pay the farm, and the farmer may not be able to pay its employees and suppliers; in worst-case scenarios, the farm shuts down. Put more simply, if the farmer doesn’t get paid, then the farmer doesn’t grow.

Working backward from the point-of-sale with the customer who innocently buys his eighth for the week, let’s assume a wholesaler provided the dispensary terms for its purchase. A typical arrangement might be Net 30; meaning, upon delivery, the dispensary has 30 days to pay for the product. When 30 days come and goes, the ripple effect is tremendous. Using a basic understanding of the velocity of money, the more money turns over (gets handed from one party to another) the more economic activity is generated. (As an aside, the size of any economy is the amount of money in the system multiplied by the number of times the money turns over.)

Cannabis growers can make money but there are risk

This situation raises numerous issues of risk management. But working through those issues can lead to business practices that dramatically reduce risk. Cannabis risk management is the most hard-won wisdom a cannabis business will acquire. It is the result of the classic school of hard knocks curriculum.

Though we have given a simple grower, wholesaler, retailer mechanism as our example, the lessons to be learned are fairly generic and apply across the whole spectrum of cannabis verticals. Payment risk is the first truly systemic risk in the cannabis business.

So, what can a farmer do that can also provide good insight for other cannabis verticals?

1: Cannabis growers can make money when they diversify where you wholesale.

First, farmers can diversify their outlets for product distribution. Relying on one wholesaler to distribute all of your product is the riskiest and most expensive strategy. You are at the whim of their salespeople, collection department, and you look to the wholesaler to give you facts on the ground for pricing. There is an innate conflict-of-interest on the part of the wholesaler: Like trying to sell anything on consignment (at least in Oregon), the farmer loses much more when products are sold at a lower price, but those lower prices help the wholesaler (who gets commission) sell more. For example, if the commission structure is 20% to the wholesaler and the wholesaler reduces the price of a pound of flower by $100, you lose $80, but the wholesaler’s commission is only reduced by $20. The takeaway: Make sure the wholesaler gets your approval before lowering prices.

It is not the wholesaler’s responsibility to ensure the farmer’s financial wellbeing. Farmers are captive and at very high risk of any hiccups the wholesaler experiences.

To avoid becoming beholden to a single distributor, never sign an exclusive distribution agreement. Your aim should be to diversify your distribution channels to the extent of your management team’s ability. An ideal strategy is to have a few non-exclusive wholesalers who do not overlap geographically and for one or more of your management team members to act as the point-of-contact for dispensaries that are not obvious markets for your non-exclusive wholesalers.

The benefits of such a strategy are numerous: You have wholesalers working hard to keep their relationships with you as you are not beholden to one captive distribution party. Also, by actually visiting and selling cannabis directly to dispensaries, even if such sales are only a small part of your overall revenue, you build invaluable relationships and pick up your own on-the-ground intel. As an added benefit, your direct sales have higher margins as you save by not paying commission on them. So, your effective commission rate (the blending of wholesaler commissioned sales and non-commission direct sales) will provide you with an economical distribution strategy. It is best to be transparent with your non-exclusive wholesale partners and assure them you are not selling directly into their markets. Trust still matters in this industry.

2: Cannabis growers can make money when you limit your sales to each channel, and budget extra time and resources.

The second major factor in your risk management strategy should be to have internal caps on whatever it is that your business extends to third parties. For example, you can put a wholesale dollar cap on the amount of flower you entrust with a wholesaler. The cap is relative to your size as a grower. For instance, $5,000 might be enough to not keep you up at night if you are a small grower. Or, if you are a larger grower, $100,000 might be comfortable.

You will want to put in other risk mitigation measures if you sense a problem with a customer. For example, let’s say a dispensary is late in paying its Net 30 bill. You might have a policy not to provide any more flower until a late bill is made current. One of the strategies we find helpful when a receivable is late is not to make a demand for the full amount immediately: It is a good way to have your calls and communications ignored. Instead, start by asking for a good faith “down payment” on the late receivable. If the situation is dire, go right into setting up a payment plan over an agreed upon number of months and decide whether you will continue to do business with the customer on normal terms as long as they are current on the payment plan.

This cap strategy can be used in all cannabis verticals. For an oil extract company, it will include caps for sending products out to kitchens, for example, and establishing what amount of time to allow the kitchen to create its products and sell them into the market.

The best risk management strategy is the most simple yet the least utilized.

3: Cannabis growers can make money when they Trust but verify.

Finally, the best risk management strategy is the most simple yet the least utilized. We in the cannabis industry sometimes feel a kindred connection to others in the industry and this results in us being overly trusting. Nothing is wrong with being trusting, it is just that the trust might not be based on anything solid. This is dangerous for new relationships or relationships in which due diligence has not been undertaken.

The simple fix to this problem is having an upfront conversation. A lot of times insufficient time or inclination exists to put in place formal legal documents for most relationships. This is just the state of the industry. In lieu of such documents, having a simple conversation around expectations and what one party should say to the other when a hiccup occurs will go a long way to enhance transparency between the parties.

We recently ran into a situation where a customer bounced multiple checks totaling upwards of five figures. One of our senior managers took it upon himself to have a non-judgmental conversation with the firm’s owner asking that the owner be completely transparent on how he got into such a position. Once we got the story, we devised a plan, and the customer executed on that plan. The customer even voluntarily said they would hold off on doing business with us until the balance is cleared. Customer, relationship, ego, and business all saved. It would have been much better to have the transparency conversation at the start of the relationship. Nevertheless, the strategy worked once the trim hit the fan.

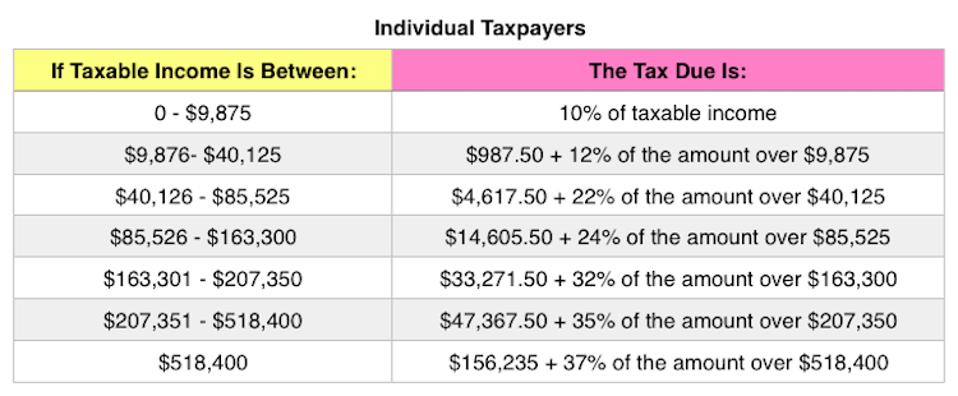

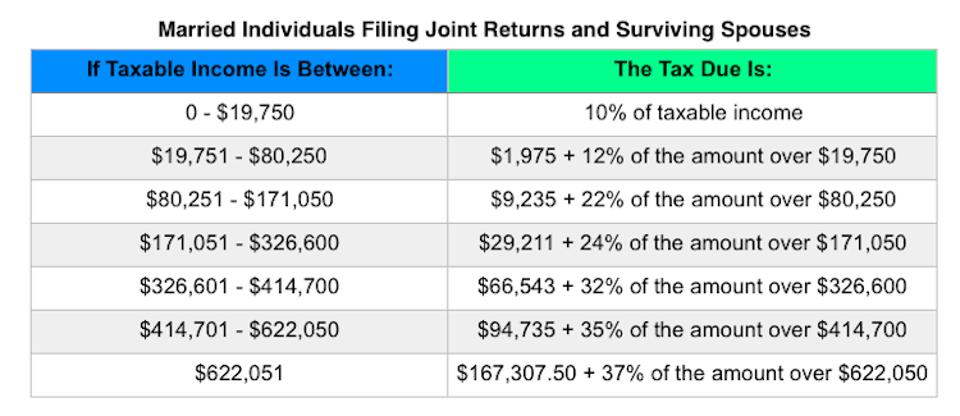

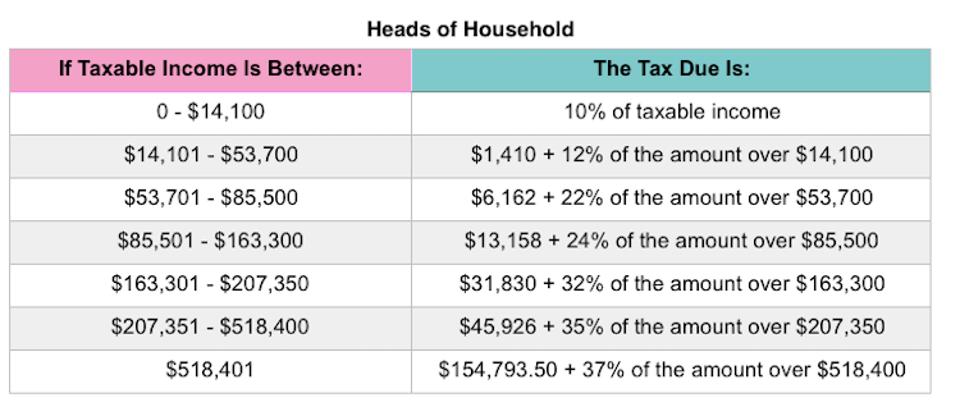

One of the first elements to getting your biggest refund is making sure you don’t miss any tax credits or deductions you deserve. If your circumstances have changed from last year, there may be a number of new credits or tax deductions available to you. Because you may not know that you’re eligible, a Tax Pro can help you make sure you don’t leave any money on the table. Visit our Tax Refund Calculator to get your estimate.

One of the first elements to getting your biggest refund is making sure you don’t miss any tax credits or deductions you deserve. If your circumstances have changed from last year, there may be a number of new credits or tax deductions available to you. Because you may not know that you’re eligible, a Tax Pro can help you make sure you don’t leave any money on the table. Visit our Tax Refund Calculator to get your estimate.