2020 Tax Deduction Amounts And More

2020 Tax Deduction Amounts And More

These are the numbers for the tax year 2020 beginning January 1, 2020. They are not the numbers and tables that you’ll use to prepare your 2019 tax returns in 2020 (you’ll find them here). These are the numbers that you’ll use to prepare your 2020 tax returns in 2021.

If you aren’t expecting any significant changes in 2020, you can use the updated numbers to estimate your liability. If you plan to make more money or change your circumstances (i.e., get married, start a business, have a baby), consider adjusting your withholding or tweaking your estimated tax payments. To check out the new IRS withholding estimator, click here.

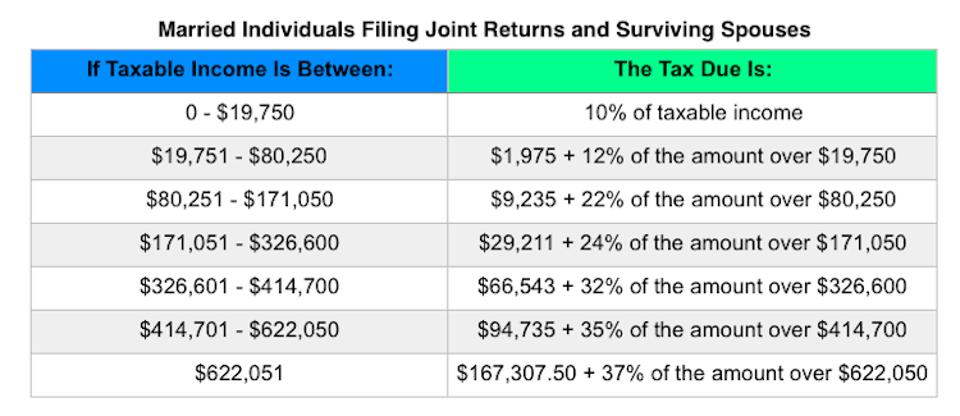

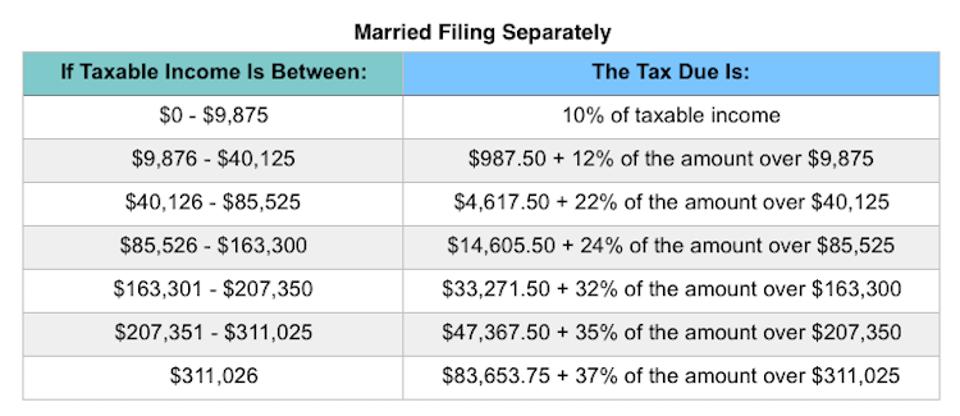

Tax Brackets and Tax Rates. There are seven (7) tax rates in 2020. They are: 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate). Here’s how those break out by filing status:

Single Tax Deductions 2020

2020 KPE

Married Filing Jointly Tax Deductions 2020 KPE

Head of Household Tax Deductions 2020

Married Filing Separately Tax Deductions 2020

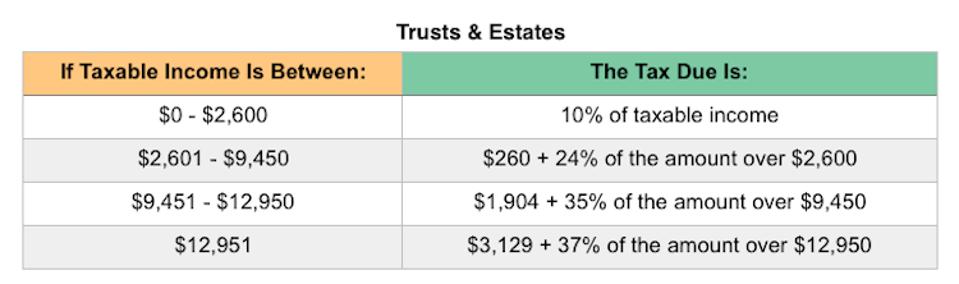

And for trusts and estates:

Filing Trust and Estates Tax Deductions 2020

KPE

Standard Deduction Amounts. The standard deduction amounts will increase to $12,400 for individuals and married couples filing separately, $18,650 for heads of household, and $24,800 for married couples filing jointly and surviving spouses.

Standard Tax Deductions 2020

- For 2020, the additional standard deduction amount for the aged or the blind is $1,300. The additional standard deduction amount increases to $1,650 for unmarried taxpayers.

- For 2020, the standard deduction amount for an individual who may be claimed as a dependent by another taxpayer cannot exceed the greater of $1,100 or the sum of $350 and the individual’s earned income (not to exceed the regular standard deduction amount).

There will be no personal exemption amount for 2020. The personal exemption amount remains zero under the Tax Cuts and Jobs Act (TCJA).

The alternative minimum tax (AMT) exemption amounts are adjusted for inflation. Here’s what those numbers look like for 2020:

Filing Alternative Minimum Tax Deductions 2020

KPE

Kiddie Tax. The kiddie tax applies to unearned income for children under the age of 19 and college students under the age of 24. Unearned income is income from sources other than wages and salary, like dividends and interest. Your child must pay taxes on their unearned income if that amount is more than $1,100 in 2020. Taxable income attributable to net unearned income will be taxed according to the brackets applicable to trusts and estates (see above). For earned income, the rules are the same as before.

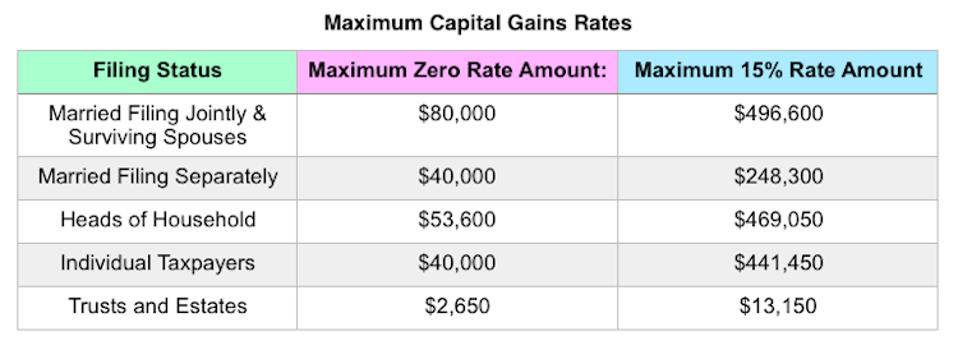

Capital Gains rates will not change for 2020, but the brackets for the rates will change. Most taxpayers pay a maximum 15% rate, but a 20% tax rate applies if your taxable income exceeds the thresholds set for the 37% ordinary tax rate. Exceptions also apply for art, collectibles and section 1250 gain (related to depreciation). The maximum zero rate amounts and maximum 15% rate amounts break down as follows:

Cap Gains 2020

There are changes to itemized deductions found on Schedule A, including:

- Medical and Dental Expenses. The “floor” for medical and dental expenses is 7.5% in 2020, which means you can only deduct those expenses which exceed 7.5% of your AGI.

- State and Local Taxes. Deductions for state and local sales, income, and property taxes remain in place and are limited to a combined total of $10,000, or $5,000 for married taxpayers filing separately.

- Home Mortgage Interest. You may only deduct interest on acquisition indebtedness—your mortgage used to buy, build or improve your home—up to $750,000, or $375,000 for married taxpayers filing separately. For more on mortgage interest under the TCJA/

- Charitable Donations. As a result of tax reform, the percentage limit for charitable cash donations to public charities increased from 50% to 60% in 2018 and will remain at 60% for 2o20.

- Casualty and Theft Losses. The deduction for personal casualty and theft losses has been repealed except for losses attributable to a federal disaster area. For more on casualty losses after a disaster.

- Job Expenses and Miscellaneous Deductions subject to 2% floor. Miscellaneous deductions, including unreimbursed employee expenses and tax preparation expenses, which exceed 2% of your AGI have been eliminated. For more info.

- There are no Pease limitations in 2020.

Some additional tax credits and deductions have been adjusted for 2020. Here’s a look at a few of the most popular:

- Child Tax Credit. The child tax credit has been expanded to $2,000 per qualifying child and is refundable up to $1,400, subject to phaseouts; there is a temporary $500 nonrefundable credit for other qualifying dependents. AGI phaseouts are not indexed for inflation and remain at $400,000 for married taxpayers filing jointly and more than $200,000 for all other taxpayers. For more about the expanded CTC.

- Earned Income Tax Credit (EITC). For 2020, the maximum EITC amount available is $6,660 for married taxpayers filing jointly who have three or more qualifying children (it’s $538 for married taxpayer with no children). Phaseouts apply.

- Adoption Credit. For 2020, the credit for an adoption of a child with special needs is $14,300, and the maximum credit allowed for other adoptions is the amount of qualified adoption expenses up to $14,300. The available adoption credit begins to phase out for taxpayers with modified adjusted gross income (MAGI) in excess of $214,520; it’s completely phased out at $254,520 or more.

- Student Loan Interest Deduction. For 2020, the maximum amount that you can deduct for interest paid on student loans remains $2,500. The deduction begins to phase out for single taxpayers with MAGI in excess of $70,000, or $140,000 for married taxpayers filing jointly, and is completely phased out for single taxpayers at $85,000 or more, or $170,000 or more for married taxpayers filing jointly.

- Lifetime Learning Credit. For the 2020 tax year, the adjusted gross income (AGI) amount for joint filers to determine the reduction in the Lifetime Learning Credit is $118,000; the AGI amount for single filers is $59,000.

- Medical Savings Accounts (MSA). For 2020, a high-deductible health plan (HDHP) is one that, for participants who have self-only coverage in an MSA, has an annual deductible that is not less than $2,350 but not more than $3,550; for self-only coverage, the maximum out-of-pocket expense amount is $4,750. For 2020, HDHP means, for participants with family coverage, an annual deductible that is not less than $4,750 but not more than $7,100; for family coverage, the maximum out-of-pocket expense limit is $8,650.

- The unpopular shared individual responsibility payment has been eliminated for the tax year 2020.

- Foreign Earned Income Exclusion. For tax year 2020, the foreign earned income exclusion is $107,600.

- And don’t forget section 199A (Qualified Business Income). As part of the TCJA, sole proprietors and owners of pass-through businesses are eligible for a deduction of up to 20% for qualified business income. The deduction is subject to threshold and phased-in amounts. For 2020, the threshold amounts begin at $326,600 for married taxpayers filing jointly:

One of the first elements to getting your biggest refund is making sure you don’t miss any tax credits or deductions you deserve. If your circumstances have changed from last year, there may be a number of new credits or tax deductions available to you. Because you may not know that you’re eligible, a Tax Pro can help you make sure you don’t leave any money on the table. Visit our Tax Refund Calculator to get your estimate.

One of the first elements to getting your biggest refund is making sure you don’t miss any tax credits or deductions you deserve. If your circumstances have changed from last year, there may be a number of new credits or tax deductions available to you. Because you may not know that you’re eligible, a Tax Pro can help you make sure you don’t leave any money on the table. Visit our Tax Refund Calculator to get your estimate.